704.684.4751

- Home

- Products

Small Business

Form 94x Series Form 990 Series Form 1099 Series W-2 Forms ACA Forms ExtensionsAccountant

Tax Professionals

- Support

- Sign In

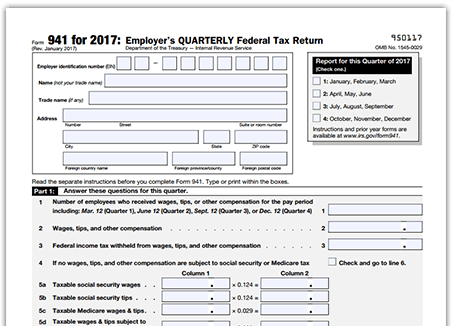

The Form 941, Employer’s Quarterly Tax Return, is used to report employment taxes. If you own and operate a business with employees, you will need to file IRS Form 941 quarterly. You, the employer, are responsible for withholding federal income tax, social security tax, and Medicare tax from each employee’s salary. This form is also used to calculate the employer's portion of Social Security and Medicare tax.

First Quarter

January - March

Second Quarter

April - June

Third Quarter

July - September

Fourth Quarter

October - December

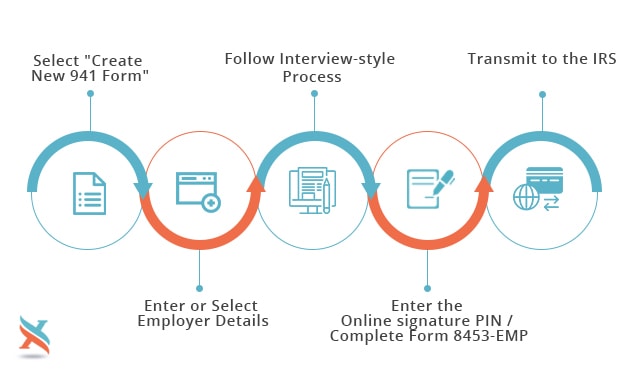

The IRS requires an e-signature to complete Form 941 to ensure that the person filing has the proper authorized from the company or business. If you don’t possess a PIN, you will need to complete and e-sign Form 8453-EMP.

ExpressTaxFilings supports e-signing of Form 8453-EMP where you can e-sign instantly when you are filing your Form 941 online. Apply for an online signature PIN for free today. Apply Now

Failure to file by deadline will result in a 5% penalty on the tax return for each month the return is late. This penalty caps at 25%. The IRS will also heavily penalize you for late payment or not paying the full amount owed. You will be charged 2-15% of the unpaid tax determined by the number of days it remains unpaid.

Late deposit penalty amounts are determined using calendar days, starting from the due date of the liability.