704.684.4751

- Home

- Products

Small Business

Form 94x Series Form 990 Series Form 1099 Series W-2 Forms ACA Forms ExtensionsAccountant

Tax Professionals

- Support

- Sign In

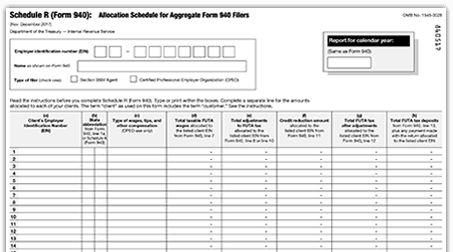

CPEOs and Section 3504 Reporting Agents are required to attach Schedule R (Form 940) to Form 940, Employer’s Annual Federal Unemployment (FUTA) Tax Return. Schedule R simplifies the aggregate reporting process by allocating aggregate wages, taxes, credits, deposits, and payment amount to be reported on Form 940.

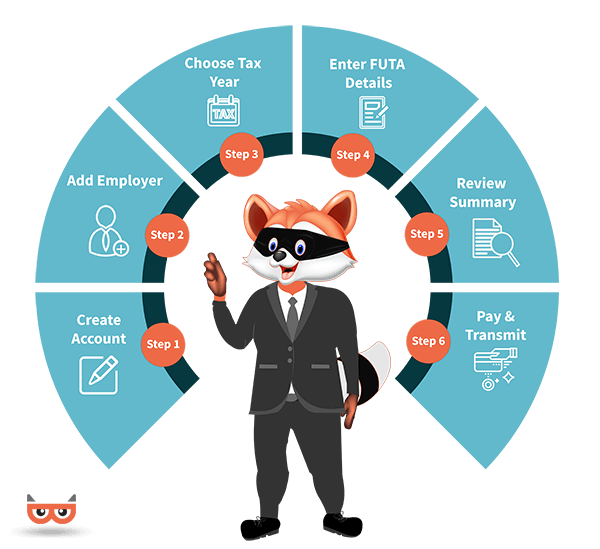

CPEOs can file the returns listed on Form 8973, and are generally required by the IRS to file their Schedule R electronically. Section 3504 Agents can file the returns listed on their Form 2678 appointment. Aggregate filers can use their own EIN to file a single Form 940 for all of their clients via Schedule R, along with those clients’ respective FUTA wage and tax liability information.

Apart from CPEOs, Aggregate Form 940s for home care service recipients are filed by agents (approved by the IRS under section 3504 through Form 2678, unless you are a state or local government agency acting as agent).

The following information must be provided to file Schedule R (Form 940):

Generally, the CPEO is solely responsible for paying the client's employment taxes, filing returns, and making deposits and payments for the reported taxes. IRC Section 3504 Agents and their clients are both responsible for paying their employment taxes, filing returns, making deposits and payments for the reported taxes.

Late-deposit penalty amounts are determined using calendar days, starting from the due date of the liability.

File Your Tax Return On Time! Avoid Your Penalties!