704.684.4751

- Home

- Products

Small Business

Form 94x Series Form 990 Series Form 1099 Series W-2 Forms ACA Forms ExtensionsAccountant

Tax Professionals

- Support

- Sign In

The Form 944, Employer’s annual Tax Return, is used to report employment taxes. IRS Form 944 is specifically for small business owners to report annual federal income tax & FICA tax with the IRS. Small employers with an annual liability of $1,000 or less for Social Security, Medicare, and federal income tax have to file annual information returns instead of the quarterly form 941.

Are you ready to prepare your Form 944? Get started with your free TaxBandits account and easily file Form 944 for 2018 or even 2017. Start Filing Now

IRS Form 944 must be filed instead of Forms 941, 941-SS, or 941-PR in order to report:

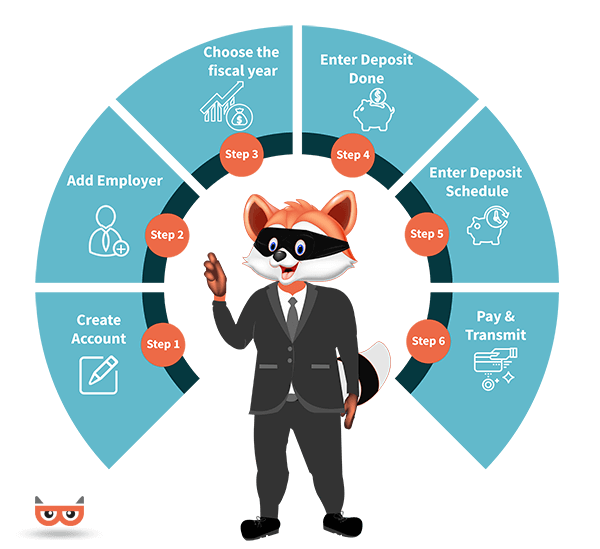

It's quite simple to file your 944 Form with TaxBandits. Just follow these steps!

Getting started with our software is simple and FREE. Create forms easily with our step-by-step interview-style process, review your form summary, and transmit directly to the IRS at just $9.95/form. You pay only when you are ready to transmit your return to the IRS.

Failure to file IRS Form 944 by the deadline will result in a 5% penalty on the tax owed for each month the return is late (this penalty caps at 25%). When you pay late or do not pay the full amount owed, you will be charged 2-15% of the unpaid tax determined by the number of days the amount remains unpaid. Learn More

If your annual liability for Social Security, Medicare, and withheld federal income tax is more than $1,000 and you are a Form 944 annual filer that must also file quarterly tax Form 941, 941-SS, or 941-PR, you must call the IRS between January 1, 2019 and April 1, 2019 or send a written request between January 1, 2019 and March 15, 2019.

Excellent Step by Step process and easy to go back and make edits....

- Luis CollazoVery easy navigation going forward and backwards. I usually have trouble online with confusing instructions. Yours is very easy.

- Jay PolonskyEasy and reasonably priced. Great customer service!

- Allen CohenI’m quite impressed, especially in comparison with other sites from the IRS list I reviewed as well. Well done. Thank you.

- Igor MandrykaVery easy to find my way around, most help features are very good, customer service response has been exceptional for the price point.

- Jerry MorrisWork flow makes sense, navigation is easy, customer service is excellent with prompt call backs and thoughtful support.

- Michael Morris