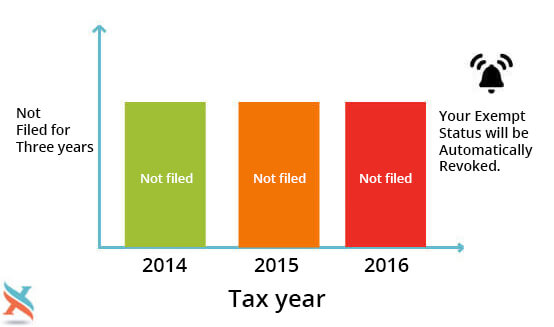

Automatic Revocation of Tax Exempt Status

Organizations that fail to file their annual 990 Information Returns for three consecutive years will lead to Automatic Revocation of the organization's tax exempt status by the IRS. Once an organization has been revoked, it can no longer receive tax-deductible contributions and will be removed from the cumulative list of tax exempt organizations.

Although exempt organizations can lose its tax exempt status, it can be reinstated through a reinstatement process. Depending on the type of organization, this progress begins by filing one of the following appropriate form: Form 1023, Form 1023-EZ, or Form 1024.

The procedure to reapply for tax exempt status from the IRS depends on various factors and scenarios. These include:

- Automatic Revocation occurring for the first time or consecutively.

- Transaction Level of the Organization - Based on the type of form used for annual filing (Form 990-N, Form 990-EZ, or Form 990).

- Time of Refiling - Based on if the organization attempted to refile on the postmark date, within 15 months of the date of revocation or after 15 months of the date of revocation.

- Statement of Reasonable Cause - This statement will provide the IRS insight on why the organization failed and how they plan to ensure that failure does not happen again. This statement is required for any failure-to-file year or for all three years.

For detailed information on identifying the procedure for filing of reinstatement that would best fit your Organisation, please click: https://www.irs.gov/charities-non-profits/charitable-organizations/automatic-revocation-how-to-have-your-tax-exempt-status-retroactively-reinstated